A related account is Insurance Expense, which appears on the income statement. The amount in the Insurance Expense account should report the amount of insurance expense expiring during the period indicated in the heading of the income statement. Selling equipment that was used for operations and administrative purposes has two effects on the cash flow statement. There are a few ways you can calculate your depreciation expense, including straight-line depreciation. Straight-line depreciation is the easiest method, as you evenly spread out the asset’s cost over its useful life. The cost of machinery does not include removing and disposing of a replaced, old machine that has been used in operations.

Great! The Financial Professional Will Get Back To You Soon.

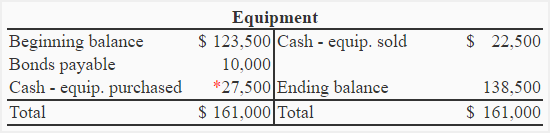

When the check is written, the accounting software will automatically make the entry into these two accounts. They are part of the total of the company’s operating costs, which you can locate in the statement’s expenses section. The simple method explained in this exercise can be used to compute the cash paid for any fixed asset.

What is the Cash Payment Journal? Example, Journal Entries, and Explained

- Secured loans are backed by business assets, which means lower interest rates and better favorable terms.

- The cost of machinery does not include removing and disposing of a replaced, old machine that has been used in operations.

- As a result, fixed assets play a critical role in the success of a business.

- Even if the market value of the asset changes over time, accountants continue to report the acquisition cost in the asset account in subsequent periods.

The loss recognized from the sale should be added back to net income in the operating activities section and proceed as a cash inflow for investing activities. It’s a positive adjustment in the operating section because it reduced net income but had no effect on cash flow. The operating section of the cash flow statement is not a report of the direct cash inflows and outflows. Instead, it starts with net income from operations—which must match the profit and loss statement—and then shows the adjustments necessary to arrive at the cash flow from operations. Since the gain on the sale increased net income but not cash, the gain is a negative adjustment in the operating section of the cash flow statement. A gain on sale of equipment means that the selling price is higher than the equipment’s adjusted basis.

Exploring 5 equipment finance options

But, you also need to account for depreciation—and the eventual disposal of property. For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. It becomes easier to manage monthly payments without straining your budget. These loan types may require you to make a down payment, which can be as much as 20% of the equipment’s cost. Therefore, maintaining a good credit score is key when considering an equipment loan, as it directly impacts the amount you’ll end up paying.

As such, you don’t drain your cash reserves, which can be channeled to other important business areas. Now, you are stuck with repaying five extra years on a machine that is no longer operational. Leasing might be a better option if you can’t afford the down payment. There are significant pros to leveraging this type of business loan in your organization.

For example, it is not practical for the retail store to provide credit sales to the consumers. And, record new equipment on your company’s cash flow statement in the investments section. The acquisition cost of a plant asset is the amount of cost incurred to acquire and place the asset in operating condition at its proper location. Cost includes all normal, reasonable, and necessary expenditures to obtain the asset and get it ready for use. Acquisition cost also includes the repair and reconditioning costs for used or damaged assets as longs as the item was not damaged after purchase.

He has a CPA license in the Philippines and a BS in Accountancy graduate at Silliman University. The journal entry you make depends on whether the asset is fully depreciated and whether you sell it for a profit or loss. Let’s say you need to create journal the next child tax credit payment pays out aug 13 entries showing your computers’ depreciation over time. You predict the equipment has a useful life of five years and use the straight-line method of depreciation. Accounting for assets, like equipment, is relatively easy when you first buy the item.

All of our content is based on objective analysis, and the opinions are our own. Yes, certain laws and regulations limit how much money a person or business can withdraw from their bank in cash without having to declare it for tax purposes. Check with your local authority for more information about the specific limits that may apply in your area. This makes the purchasing process easy and may include friendly rates. If this loan type isn’t the right fit for your SMB, other options exist. They can offer more flexibility, quicker approval times, and tailored solutions to fit your unique business needs.